If you are looking to get better returns than your bank fixed deposits and do not want to take the risk, post office small savings schemes are the best choice for you. Currently, most post office savings schemes provide higher returns than bank fixed deposits.

Seamless transfers during flights can make travel a breeze. Similarly, seamless transfers between accounts can offer ease. Internet and mobile banking can help you transfer funds from your post office account in a jiffy. Here is a step-by-step guide to post office net banking and mobile banking facility.

Key highlights:

Post office net banking and mobile banking offer a hassle-free way to manage your post office savings account

A simplified step-by-step guide activates post office net banking and offers seamless fund transfers and various online services

Post office mobile banking enables you to conveniently access your account using the India Post Mobile Banking app

Here’s how to activate post office net banking and mobile banking

You will need to have the below details to avail internet banking:

An active mobile number, an email ID, and PAN numbers linked to your post office savings account

Valid Joint B Savings account or Active Single while standing at CBS Sub Post Office

Necessary KYC documents, if not submitted

If you have a standing account at Branch Post Office, you are not eligible to avail of the internet banking facility.

What is the procedure for post office net banking activation?

Follow the steps below to activate post office online banking:

- Visit your nearest post office and fill out the form — ‘ATM Card/Online/Mobile/SMS banking application form’. This form is also available at (https://www.indiapost.gov.in/VAS/Pages/Form.aspx). Once the form is filled out, you need to submit it at the post office.

- Once you submit the form, the post office internet banking service is activated, and you receive an SMS alert on your registered mobile number.

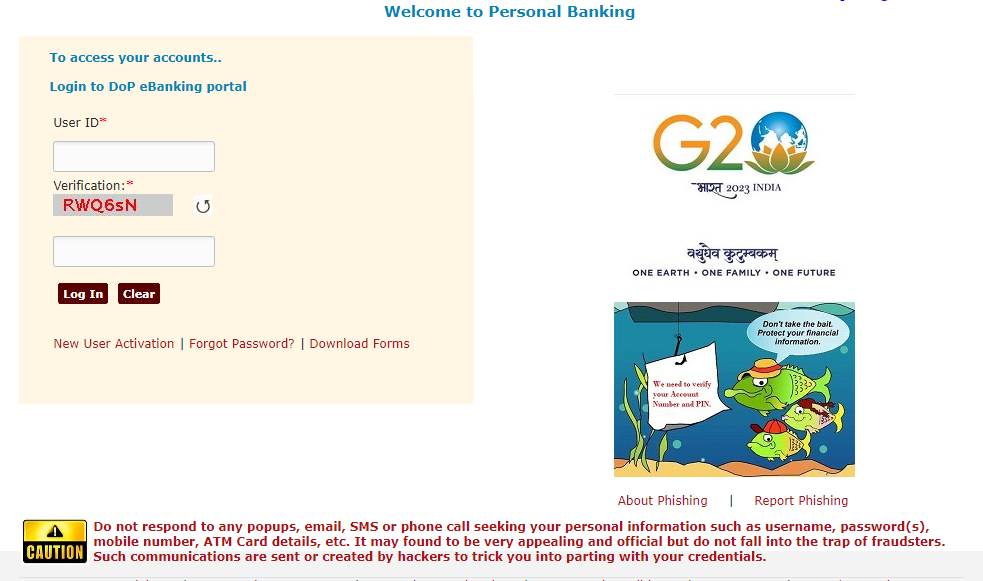

- Go to the website https://ebanking.indiapost.gov.in, and click on ‘New User Activation’. You will have to provide the customer ID, which is your CIF ID. This ID can be found on the first page of your savings account passbook. The Account ID is your savings account number.

- Fill in the necessary details and set your internet banking and transaction passwords. Both cannot be the same.

- Login using the user id and password and set up your security questions. Once done, your online banking user ID is activated successfully.

Features available under post office net banking

You can use your POSB account to transfer funds from your account to other POSB accounts belonging to you or a third party. You can perform the below activities as well:

PPF Withdrawal and PPD Deposit.

TD and RD accounts can be opened through Internet Banking.

Stop cheque payment.

SSA deposit.

Beneficiaries can be added.

<

Procedure to activate post office mobile banking

With a post office savings account, you can also use the mobile banking service. Before you activate it, you must have an appropriate Internet banking username and transaction credentials. If net banking is not activated, you must enable it at the service outlet once the CIF has enabled the net banking alternative. Follow the below steps in order to activate your mobile banking:

- Fill out the mobile banking application and submit it. You will have to go through KYC norms while submitting your application form, in case you have not submitted it.

- You should have a unique mobile number. You cannot use the same mobile number for more than one CIF or customer ID.

- Once the form is submitted, your mobile banking service will be enabled within 24 hours.

- You can download the ‘India Post Mobile Banking’ app from the AppStore or PlayStore on your mobile phone.

- Your CIF ID will be your user ID, and your transaction password will be the password you configured in your Internet banking account.