Postmen and Gramin Dak Sevaks are integral to IPPB’s outreach strategy. They serve as the face of the bank in local communities and help bridge the gap between traditional postal services and modern banking. Their primary role includes customer acquisition, deposit mobilization, disbursement of loans, and facilitating various banking transactions.

To motivate and compensate Postmen and GDS for their efforts in promoting IPPB services, a commission structure is in place. They receive commissions based on the business they generate and the transactions they facilitate on behalf of the bank. This commission structure typically includes:

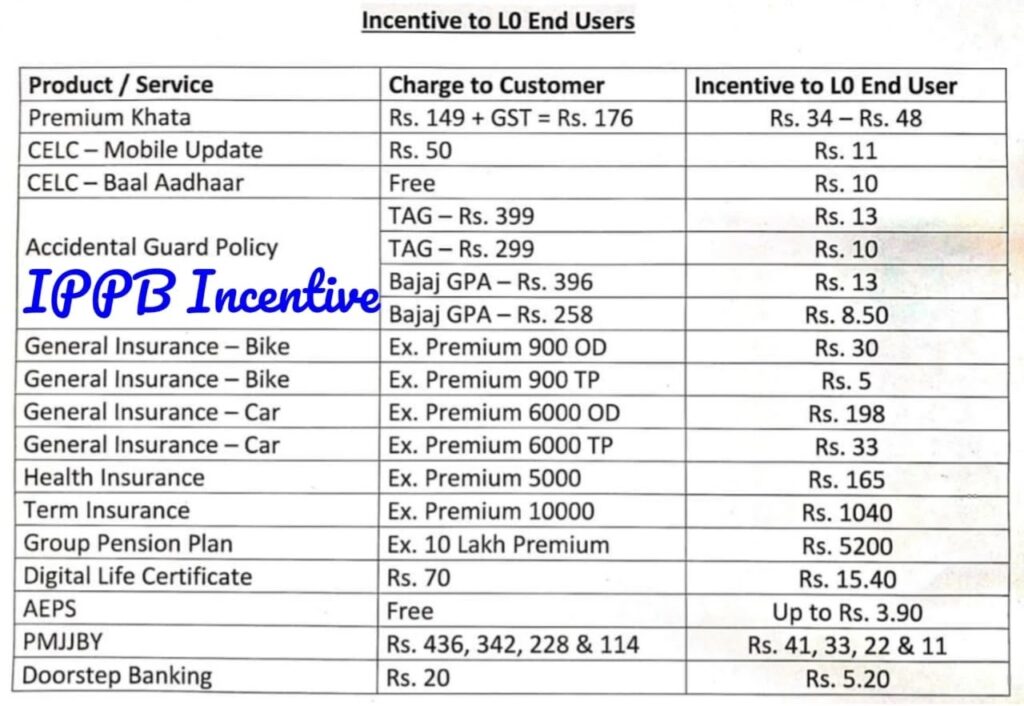

Latest (Updated) IPPB Incentive (Commission) for DOP End Users (GDS, Postman & PA) 2023.

| IPPB Product/Service | Charge to Customer | IPPB Incentive to L0 (GDS, Postman, PA) End User |

| Premium Khata | ₹ 149+GST = ₹ 176 | ₹ 34- ₹ 48 |

| CELC – Mobile Update | ₹ 50 | ₹ 11 |

| CELC – Baal Aadhar | Free | ₹ 10 |

| Accidental guard policy | TAG – ₹ 399 TAG – ₹ 299 | ₹ 13 ₹ 10 |

| General Insurance -Bike | Ex. Premium 900 OD | ₹ 30 |

| General Insurance – Bike | Ex. Premium 900 TP | ₹ 5 |

| General Insurance – Car | Ex. Premium 6000 OD | ₹ 198 |

| General Insurance – Car | Ex. Premium 6000 TP | ₹ 33 |

| Health Insurance | Ex. Premium 5000 | ₹ 165 |

| Term Insurance | Ex. Premium 10000 | ₹ 1040 |

| Group pension plan | Ex. 10 Lakh premium | ₹ 5200 |

| Digital life certificate | ₹ 70 | ₹ 15.40 |

| AEPS | Free | Up to ₹ 3.90 |

| PMJJBY | ₹ 436, ₹ 342, ₹ 228, ₹ 114 | ₹ 41, ₹ 33, ₹ 22, ₹ 11 |

| Doorstep Banking | *Nil | ₹ 5.20 |